ESG data are provided by

ESG Rating

The most prominent feature is the company's ESG rating, expressed as a letter grade. This rating summarizes how well a company manages material ESG risks and opportunities relative to its industry peers. Ratings are assigned on a seven-point scale from CCC (the lowest) to AAA (the highest):

|

AAA: The company is a leader in managing ESG risks. It has robust systems in place to address relevant environmental, social, and governance challenges.

|

|

AA to A: The company demonstrates above-average performance in managing ESG factors compared to its peers.

|

|

BBB to BB: Indicates the company has an average level of performance in managing ESG risks and opportunities.

|

|

B to CCC: The company is considered a laggard, with significant challenges or a lack of management on key ESG issues.

|

These ratings provide a quick snapshot of how well a company is positioned to mitigate long-term sustainability risks.

For more information, see MSCI's documentation

Significant Controversies by Indicator

The most prominent feature is the company's ESG rating, expressed as a letter grade. This rating summarizes how well a company manages material ESG risks and opportunities relative to its industry peers. Ratings are assigned on a seven-point scale from CCC (the lowest) to AAA (the highest):

Environment Rating

MSCI ESG Controversies provides timely and consistent evaluations of ESG-related controversies. It measures a company's involvement in negative activities reported by media, NGOs, and other stakeholders. Analysts at MSCI review allegations of controversial events or practices and assign scores based on the severity of the impact, the company's role, and the status of the resolution between the company and stakeholders.

MSCI ESG Controversies Flags are leveraged to identify corporate entities implicated in third-party allegations concerning practices or incidents that may contradict recommendations under the following global norms and conventions:

|

The Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises;

|

|

The Ten Principles of the United Nations Global Compact (UNGC);

|

|

The International Labour Organization's (ILO) fundamental conventions and ILO Declaration on Fundamental Principles and Rights at Work; and

|

|

The United Nations Guiding Principles on Business and Human Rights (UNGP).

|

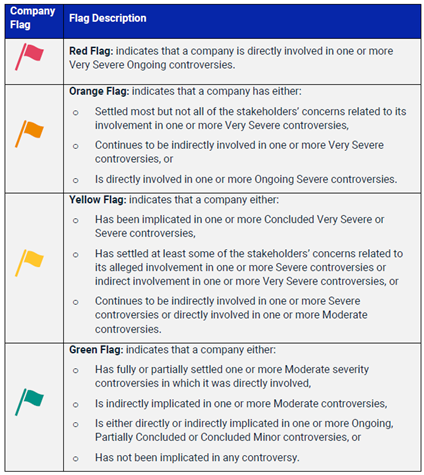

MSCI ESG Controversies is not designed to verify or confirm any allegations or claims of violations. Instead, it provides a consistent assessment of controversies in the form of scores and color-coded flags.

|

Red: Indicates that a company is involved in one or more very severe controversies.

|

|

Orange: Indicates that a company has been involved in one or more recent severe structural controversies that are ongoing

|

|

Yellow: Indicates that the company is involved in severe-to-moderate level controversies.

|

|

Green: Indicates that the company is not involved in any major controversies. However, this could indicate that the company is involved in minor or moderate controversies.

|

For more information, see MSCI's documentation

Sustainable Development Goals (SDG)

The MSCI SDG Net Alignment Score is a holistic assessment of each company's overall net contribution towards each of the 17 individual SDGs. This score takes product alignment and operational alignment into account with equal weights.

While we display the SDG Net Alignment Scores on a continuous scale [-10, 10], MSCI also categorizes these scores into five assessments. The conversion is done as follows:

|

Score >5.0: Strongly Aligned.

|

|

Score between 2.0 and 5.0, inclusive: Aligned.

|

|

Score less than 2.0 but higher than -2.0: Neutral.

|

|

Score equal to or less than -2.0 but higher than -10: Misaligned.

|

|

Score equal to -10: Strongly Misaligned.

.

|

Note: MSCI does not provide an aggregate company-level assessment.

For more information, see MSCI's documentation

Sustainable Development Goals (SDG)

The MSCI SDG Net Alignment Score is a holistic assessment of each company's overall net contribution towards each of the 17 individual SDGs. This score takes product alignment and operational alignment into account with equal weights.

|

Pass: The company has not been implicated in any controversy cases within the scope of the UNGCs, or its involvement in such cases is not considered to be severe enough to warrant a Fail or Watch List designation.

|

|

Watch List: There are three possible reasons for this assessment: 1) An alleged direct involvement in an ongoing severe controversy, or 2) the company settled most concerns related to a very severe controversy, or 3) the company continues to be involved in a very severe controversy indirectly.

|

|

Fail: An alleged direct involvement in at least one very severe ongoing controversy in an area covered by the UNGCs.

|

The individual UNGCs can be grouped into Labor, Human Rights, Environment, and Anti-Corruption. Each of which is assessed individually on a 4-level scale: green , yellow , orange , red (from best to worst).

For more information, see

MSCI's documentation

Business (Revenue) Involvement Screening

MSCI's Business Involvement Screening provides data on the extent of companies' involvement in products, services, processes or operations that may cause, contribute to, or be associated with adverse social or environmental impacts or may conflict with certain investors' values.

MSCI's Business Revenue Involvement Screenings provide reported or estimated revenue attributed to business activities.

Note: Involvement evaluations are not dependent on companies generating revenues from the screened business activities. It is possible that the outcome of an Involvement evaluation indicates involvement, whereas the Revenue Involvement evaluation output is zero.

For more information, see MSCI's documentation