---- STOCKS ----

The Global Evaluation is designed to give a fast and easy yet broadly supported evaluation of a stock. It combines the impression of fundamental and technical elements (valuation, earnings revisions, technical factors, group benchmarking) with the sensitivity rating (Bear Market & Bad News Factor). A better rating in the individual areas leads in the sum to a better Global Evaluation (scoring model).

More information

---- FUNDS ----

The Global Evaluation is designed to give a fast and easy yet broadly supported evaluation of a fund or ETF. It combines the impression of fundamental and technical elements (Information Ratio, Sharpe, technical factors) with the sensitivity rating (Bear Market & Bad News Factor). A better rating in the individual areas leads in the sum to a better Global Evaluation (scoring model).

More information

The best possible rating is five green bars  , the weakest rating is one red bar

, the weakest rating is one red bar  .

.

---- INDICES, INDUSTRIES & BENCHMARKS ----

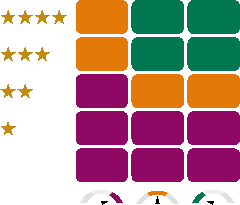

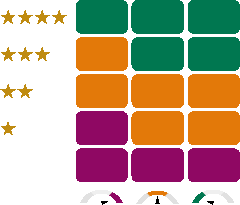

The ratings from theScreener combine the upside rating (stars) based on fundamental and technical criteria with a sensitivity rating based on the behaviour of equities over the last 12 months.

Positions can show 3 Evaluations according to the following matrix:

Since 23/07/2025:

Before 23/07/2025: